Table of Contents

Introduction

Long-term investing is the key to building sustainable wealth over time. It requires patience, discipline, and an understanding of how different strategies work to help your investments grow. In this blog, we’ll explore the big picture of long-term investing, providing a mental framework that will help you think holistically about your financial journey. By the end, you’ll have a better understanding of how to approach long-term investing and how to select a strategy that works best for you.

The Big Picture of Long-Term Investing

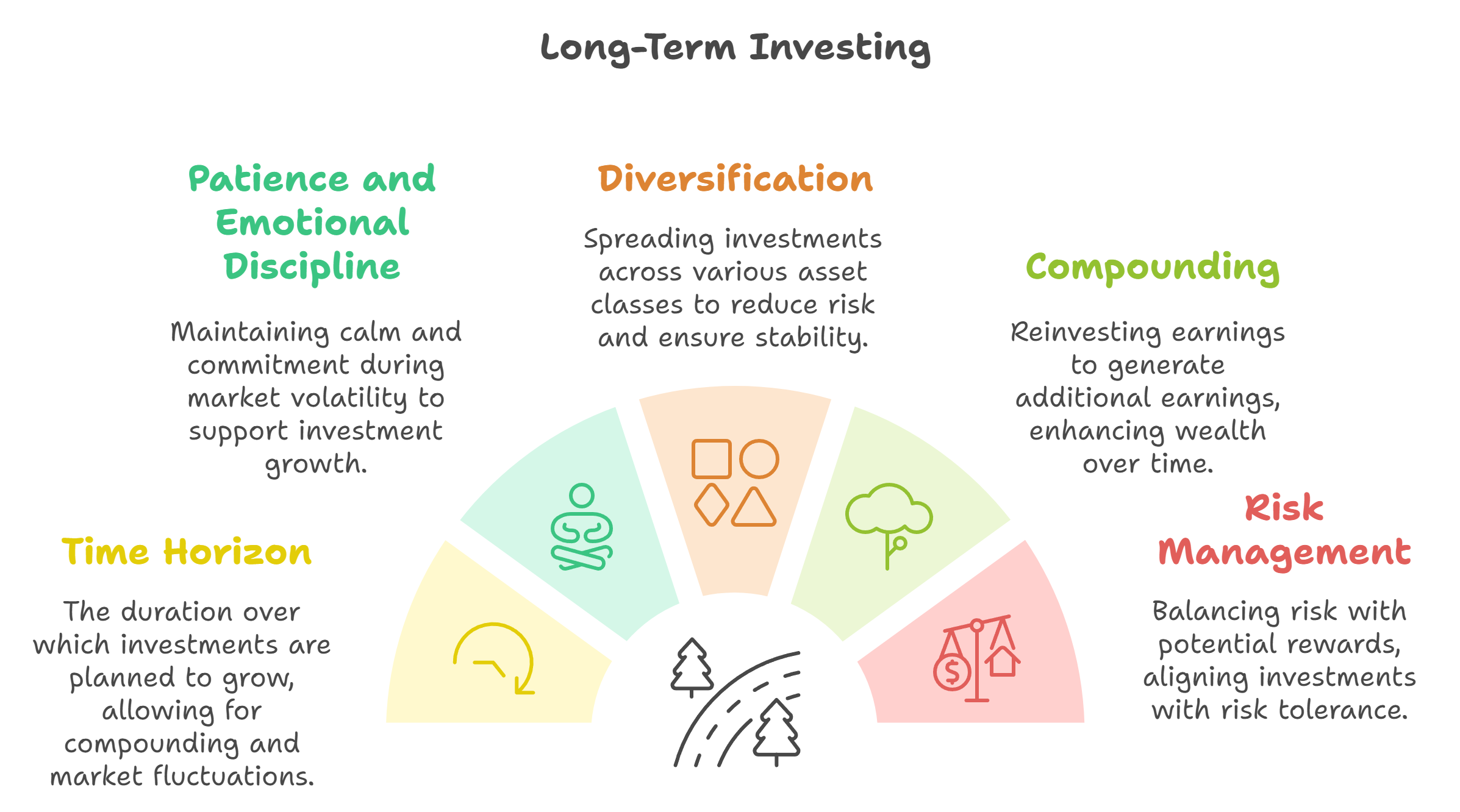

Long-term investing isn’t about chasing quick profits or trying to beat the market in the short term. It’s about adopting a steady approach that allows your investments to grow over many years, potentially even decades. Here are the key components that make up the long-term investing ecosystem:

- Time Horizon: The core of long-term investing is the time horizon. Whether you’re investing for retirement, your child’s education, or simply for future financial security, having a long-term goal gives you the flexibility to ride out market fluctuations and benefit from compounding growth.

- Patience and Emotional Discipline: The stock market is known for its ups and downs, but successful long-term investors don’t let daily price movements affect their decisions. The ability to stay calm and committed during times of market volatility is crucial for allowing your investments to grow without emotional interference.

- Diversification: Diversification is about spreading your investments across different asset classes — like stocks, bonds, real estate, and even commodities — to reduce risk. By holding a mix of investments, you can mitigate losses if one particular asset class underperforms. Diversification is a key way to ensure long-term stability.

- Compounding: Compounding is often referred to as the eighth wonder of the world, and for good reason. Compounding occurs when your earnings generate their own earnings. By reinvesting returns over time, you can significantly boost your wealth without adding more money yourself. The earlier you start, the more powerful compounding becomes.

- Risk Management: Every investment carries risk, but long-term investing allows you to manage and even out these risks over time. It’s important to understand your risk tolerance and make sure your investment choices align with your comfort level. Balancing risk with potential reward is an essential part of a long-term strategy.

Selecting a Long-Term Investing Strategy

The next step in building your long-term investment plan is choosing a strategy that aligns with your goals, risk tolerance, and time frame. Let’s take a look at a few popular long-term investing strategies:

- Value Investing: This strategy involves buying stocks that are priced below their intrinsic value. It’s about finding solid companies that are currently undervalued and holding them until the market realizes their true worth.

- Growth Investing: Growth investors look for companies that are expected to grow faster than the market. These companies may not be undervalued, but they have the potential to achieve high returns through rapid growth. The focus is on innovation and potential future success.

- Index Investing: Index investing is a passive strategy that involves buying a broad market index, such as the S&P 500. This strategy reduces risk through diversification and minimizes fees. It’s ideal for those who want a low-maintenance way to invest over the long term.

- Dividend Investing: Dividend investing focuses on companies that pay regular dividends. These are often well-established companies that generate consistent cash flow. Reinvesting dividends helps grow your wealth through compounding.

Choosing What Works for You

Not all long-term strategies are the same, and what works for one person may not be ideal for another. When selecting a strategy, consider the following:

- Your Goals: Are you investing for retirement, to buy a home, or to create a passive income stream? Different goals require different strategies.

- Risk Tolerance: How comfortable are you with risk? Some strategies, like growth investing, come with higher risk and potentially higher returns, while others, like dividend investing, provide more stability.

- Time Frame: How long do you plan to stay invested? The longer your time frame, the more risk you can afford to take.

Learn About Key Investment Theories

Long-term investing is a journey that involves understanding the different strategies available and choosing one that fits your personal situation.

Read ‘Key Investment Theories Every Long-Term Investor Should Know’ to gain a holistic understanding of how long-term strategies fit into the different key components and how different theories and practices can be implemented to see that strategy be fruitful.

Long-term investing is about more than just buying and holding stock, it’s about having a plan, understanding the components of a successful investment journey, and choosing the strategy that best fits your unique goals. By building a mental framework around time, discipline, diversification, compounding, and risk management, you’ll be well on your way to creating lasting wealth.

Ready to take the next step? Use ValueIt to explore different investment opportunities and find the strategy that works for you. Remember, successful investing is a marathon, not a sprint—the sooner you start, the further you’ll go.