Table of Contents

Introduction

The traditional view of investing assumes that individuals are rational and always make decisions that maximize their wealth. However, real-life investing is far from rational—human behavior and emotions often play a major role in decision-making. In this blog, we’ll introduce Behavioral Finance and explore some common biases that affect investors.

What is Behavioral Finance?

Behavioral Finance is a field that combines psychology and economics to explain why investors sometimes make irrational decisions. Unlike traditional finance, which assumes people act logically, behavioral finance acknowledges that emotions, cognitive biases, and social influences can lead to suboptimal decisions.

Common Behavioral Biases

- Loss Aversion

- Loss Aversion is the tendency to prefer avoiding losses over acquiring equivalent gains. For example, the pain of losing $100 feels more intense than the joy of gaining $100. This often leads investors to hold onto losing stocks for too long, hoping they will recover, instead of cutting losses early.

- Confirmation Bias

- Confirmation Bias refers to the tendency to search for, interpret, and recall information that confirms one’s preexisting beliefs. Investors may seek out information that supports their investment decisions and ignore data that suggests otherwise, leading to biased and risky choices.

- Herd Behavior

- Herd Behavior is when individuals follow the actions of a larger group, even if those actions don’t align with their own analysis. This behavior is often seen during market bubbles or crashes, where investors buy or sell assets just because “everyone else is doing it.”

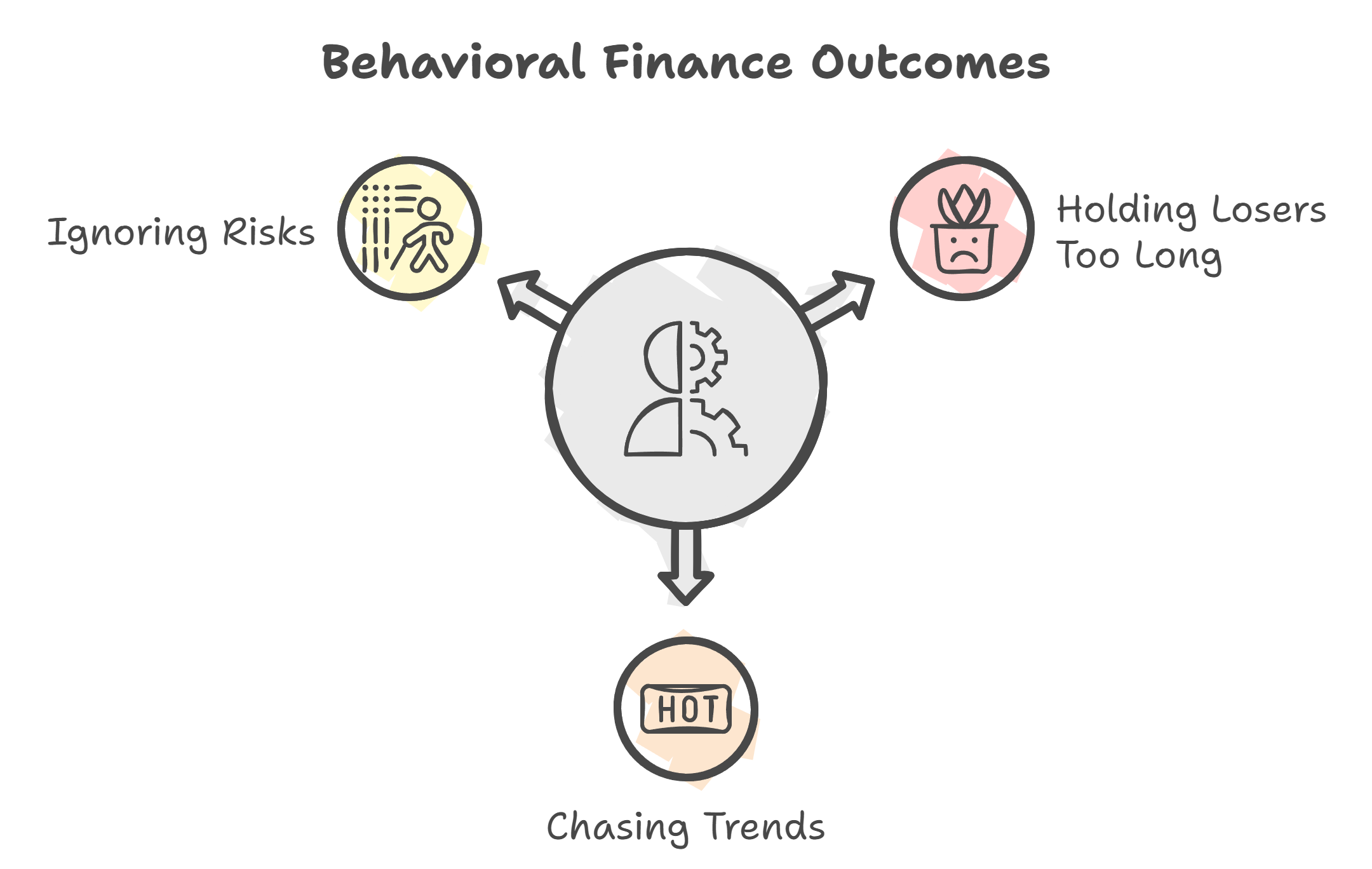

How Behavioral Biases Affect Long-Term Investing

These biases can have a significant impact on long-term investing:

- Holding Losers Too Long: Due to loss aversion, investors may hold on to underperforming assets longer than they should, hoping for a rebound that may never come.

- Chasing Trends: Herd behavior can cause investors to chase hot stocks or trends, often buying at inflated prices or selling during market panic.

- Ignoring Risks: Confirmation bias can prevent investors from seeing the real risks in their investments, leading to an overconfident approach and potential losses.

How to Overcome Biases

To be a successful long-term investor, it’s important to recognize and overcome these biases:

- Create a Plan: Having a clear, long-term investment plan can help you stay focused on your goals and prevent emotional decisions.

- Diversify: Diversification can reduce the impact of a poor decision on your overall portfolio.

- Avoid Emotional Trading: Stick to your strategy and avoid making decisions based on market hype or fear.

Behavioral Finance sheds light on how human emotions and cognitive biases affect investment decisions. By understanding biases like loss aversion, confirmation bias, and herd behavior, investors can make more rational decisions and avoid common pitfalls. Recognizing these biases is the first step toward achieving a disciplined, long-term investing approach.