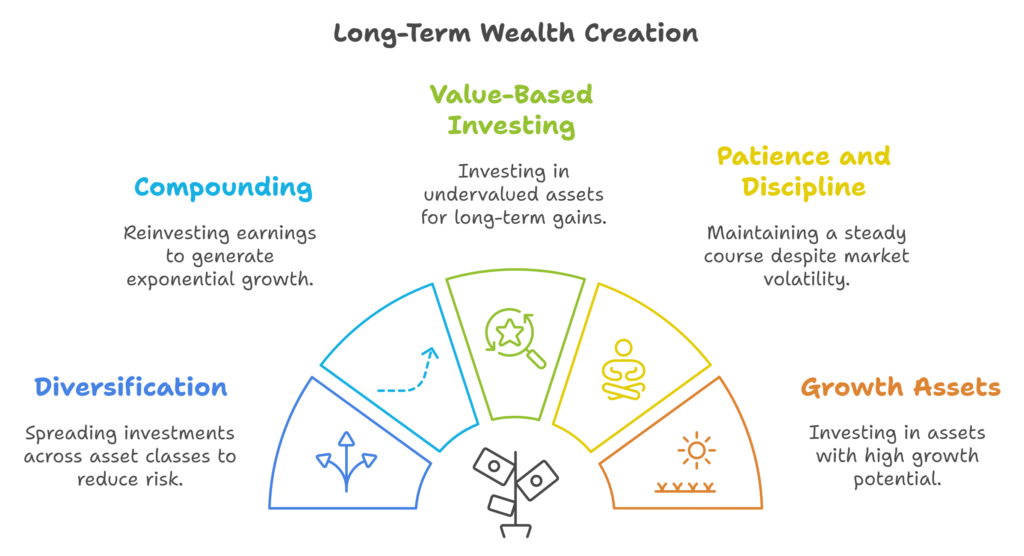

3. Five Key Strategies for Long-Term Wealth Creation

Introduction Building wealth takes time, discipline, and the right strategies. Unlike the allure of quick gains, long-term wealth creation focuses on steady growth, patience, and leveraging smart investment principles. In this blog, we’ll explore five key strategies that can help you create and grow wealth for the future. Diversification Diversification is the golden rule of […]

3. Five Key Strategies for Long-Term Wealth Creation Read More »