Table of Contents

Introduction

Asset allocation is often considered the cornerstone of a successful long-term investment strategy. It involves dividing your investments among different asset classes—such as stocks, bonds, and real estate—to balance risk and return. In this blog, we’ll discuss why asset allocation is so important, how it works, and how it can help you achieve your long-term financial goals.

What is Asset Allocation?

Asset allocation is the process of distributing your investments across various asset classes to achieve an optimal balance between risk and return. Different assets have different levels of risk and potential returns, and allocating your investments effectively helps you manage the overall risk of your portfolio.

Major Asset Classes:

- Stocks: Provide the potential for high returns but come with higher risk.

- Bonds: Generally offer lower risk and stable income but have lower returns compared to stocks.

- Real Estate: Offers diversification benefits, income through rent, and the potential for appreciation.

- Cash/Cash Equivalents: Provide liquidity and stability but minimal returns.

Why Asset Allocation Matters

Asset allocation is important for several reasons:

- Risk Management: Different assets perform differently under various market conditions. For example, bonds may perform well when stocks are struggling, which can help stabilize your portfolio.

- Align with Goals: Your asset allocation should reflect your financial goals, time horizon, and risk tolerance. If you’re young and investing for retirement, you may choose a higher allocation to stocks for growth potential. If you’re nearing retirement, a higher allocation to bonds might make sense to preserve capital.

- Reduce Volatility: By spreading your investments across asset classes, you reduce the impact of poor performance in any one area on your overall portfolio, resulting in more stable returns.

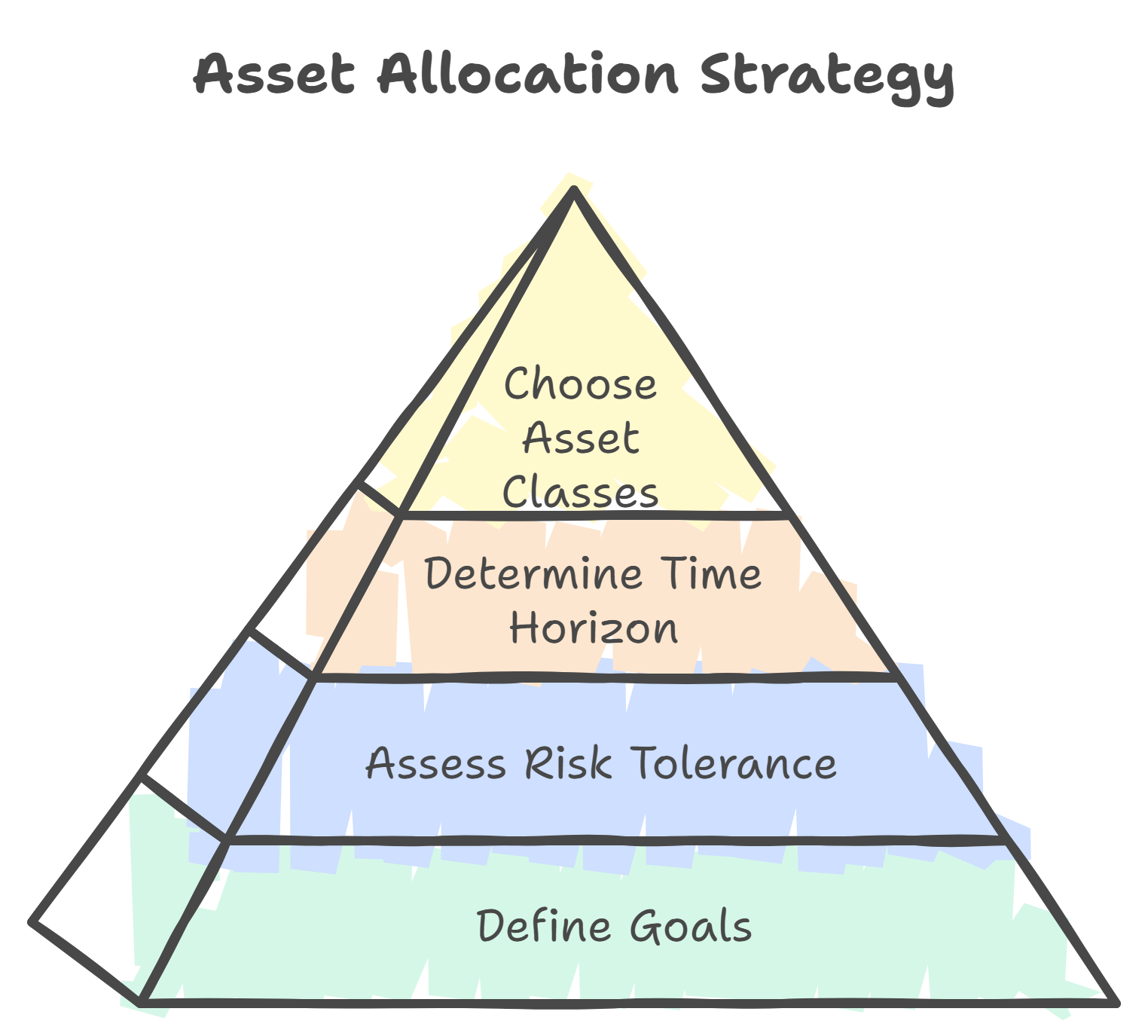

How to Create an Asset Allocation Strategy

Here are the steps to create an effective asset allocation strategy:

- Define Your Goals: Are you investing for retirement, a home purchase, or a child’s education? Different goals may require different levels of risk.

- Assess Risk Tolerance: How much risk can you afford to take? If market swings make you uncomfortable, you may prefer a more conservative allocation.

- Determine Time Horizon: The length of time you plan to invest impacts your allocation. A longer horizon allows for a more aggressive strategy, while a shorter horizon calls for a more conservative approach.

- Choose Asset Classes: Decide on the mix of stocks, bonds, real estate, and cash that aligns with your goals and risk tolerance.

Example: A young investor with a long time horizon might choose an allocation of 70% stocks, 20% bonds, and 10% real estate, focusing on growth. A retiree might opt for 30% stocks, 50% bonds, and 20% cash, emphasizing income and capital preservation.

Asset allocation is the foundation of a successful long-term investing strategy. By effectively dividing your investments across different asset classes, you can manage risk, align your portfolio with your financial goals, and achieve more stable returns over time. Remember, there is no one-size-fits-all approach—your asset allocation should be tailored to your unique situation and evolve as your circumstances change.