Table of Contents

Introduction

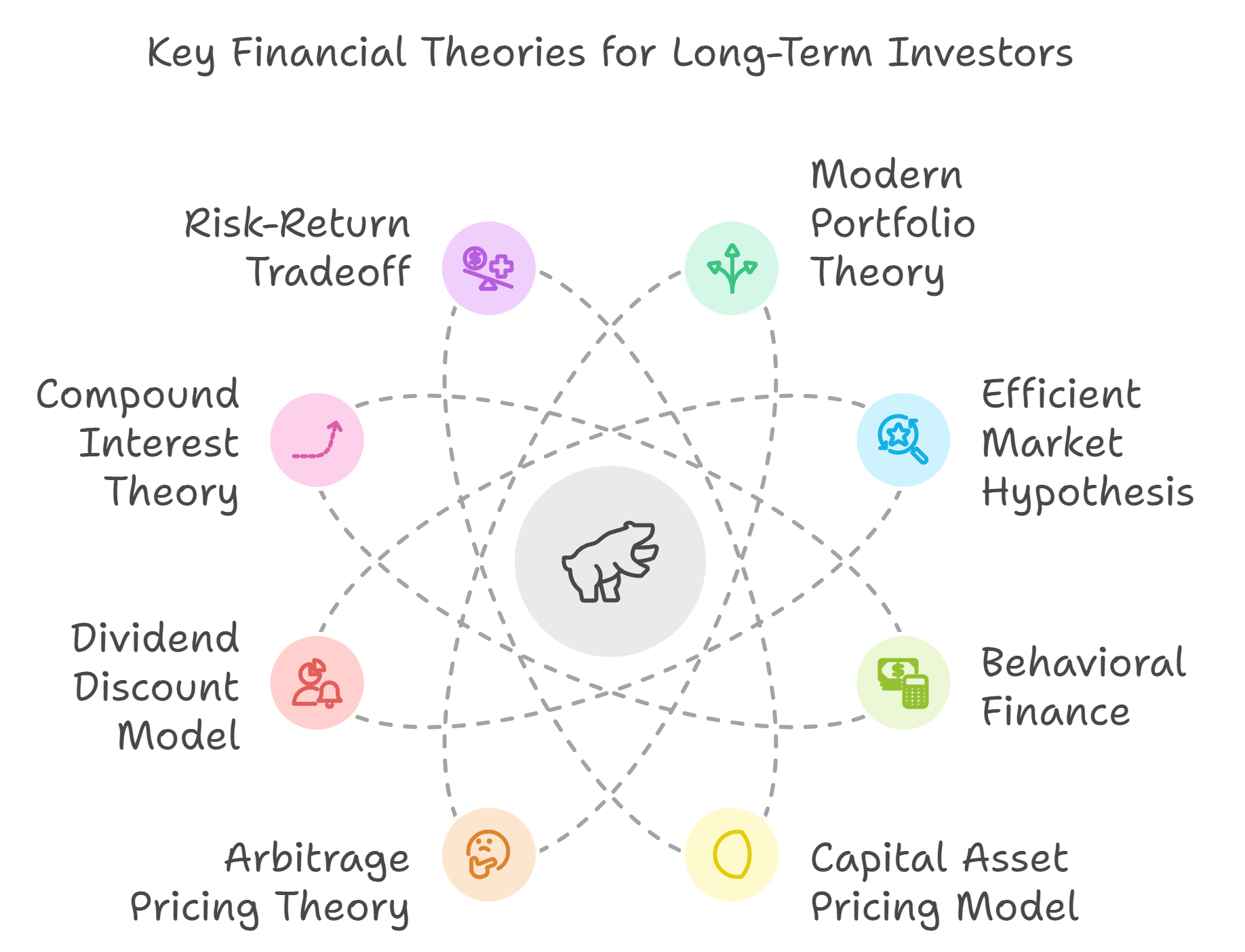

When it comes to long-term investing, having a grasp of the foundational financial theories can make a big difference in your decision-making and investment success. These theories provide a structured way to think about risk, returns, diversification, and even human behavior. In this blog, we’ll introduce some key financial theories that every long-term investor should know, including Modern Portfolio Theory (MPT), Efficient Market Hypothesis (EMH), and Behavioral Finance, among others.

Key Financial Theories for Long-Term Investors

- Modern Portfolio Theory (MPT)

Developed by Harry Markowitz, Modern Portfolio Theory is a cornerstone of investment strategy. It emphasizes the importance of diversification—spreading investments across different asset classes to minimize risk while maximizing returns. According to MPT, an “efficient portfolio” offers the highest expected return for a given level of risk. This is crucial for long-term investors aiming to balance growth and safety. - Efficient Market Hypothesis (EMH)

Proposed by Eugene Fama, the Efficient Market Hypothesis suggests that stock prices fully reflect all available information, meaning it’s nearly impossible to consistently beat the market through timing or stock picking. There are different forms of EMH — weak, semi-strong, and strong—each suggesting varying levels of market efficiency. Understanding EMH helps long-term investors set realistic expectations about market performance.

- Behavioral Finance

Traditional finance assumes that investors are rational, but Behavioral Finance recognizes that human emotions and biases often influence financial decisions. Concepts like loss aversion, confirmation bias, and herd behavior help explain why people make irrational decisions in the market. By understanding these biases, investors can make more informed and rational decisions, ultimately leading to better long-term outcomes. - Capital Asset Pricing Model (CAPM)

The Capital Asset Pricing Model is used to determine the expected return of an asset based on its risk in relation to the market. CAPM helps investors understand the relationship between risk and return, and whether an investment offers sufficient return for its level of risk. This theory can help long-term investors assess whether an asset is a suitable addition to their portfolio. - Arbitrage Pricing Theory (APT)

Similar to CAPM, Arbitrage Pricing Theory argues that an asset’s return is influenced by several macroeconomic factors, such as interest rates or inflation. Unlike CAPM, APT is more flexible and allows for multiple factors that affect asset prices, making it useful for long-term investors seeking to understand how different variables impact returns. - Dividend Discount Model (DDM)

The Dividend Discount Model is particularly useful for those interested in dividend investing. It evaluates stocks by predicting the present value of future dividends, helping investors determine whether a stock is undervalued or overvalued. DDM is a great tool for long-term investors focusing on income-generating investments. - Compound Interest Theory

Compound Interest is often referred to as the eighth wonder of the world. It involves reinvesting earnings to generate more earnings, leading to exponential growth over time. The earlier you start, the more powerful the effect of compounding. For long-term investors, understanding compound interest is crucial for wealth creation. - Risk-Return Tradeoff

The Risk-Return Tradeoff states that higher risk is associated with higher potential returns. Investors must understand their own risk tolerance and balance it with their expected returns. Tools like the Sharpe Ratio help measure risk-adjusted returns, aiding long-term investors in making sound investment choices.

Understanding these financial theories is a critical step toward becoming a successful long-term investor. They provide a structured way to think about risk, return, market efficiency, and human behavior, which are all important factors in the investment journey. Whether it’s Modern Portfolio Theory, Behavioral Finance, or understanding the power of compounding, these theories offer valuable insights that can help you make informed decisions and grow your wealth over time.