Table of Contents

Introduction

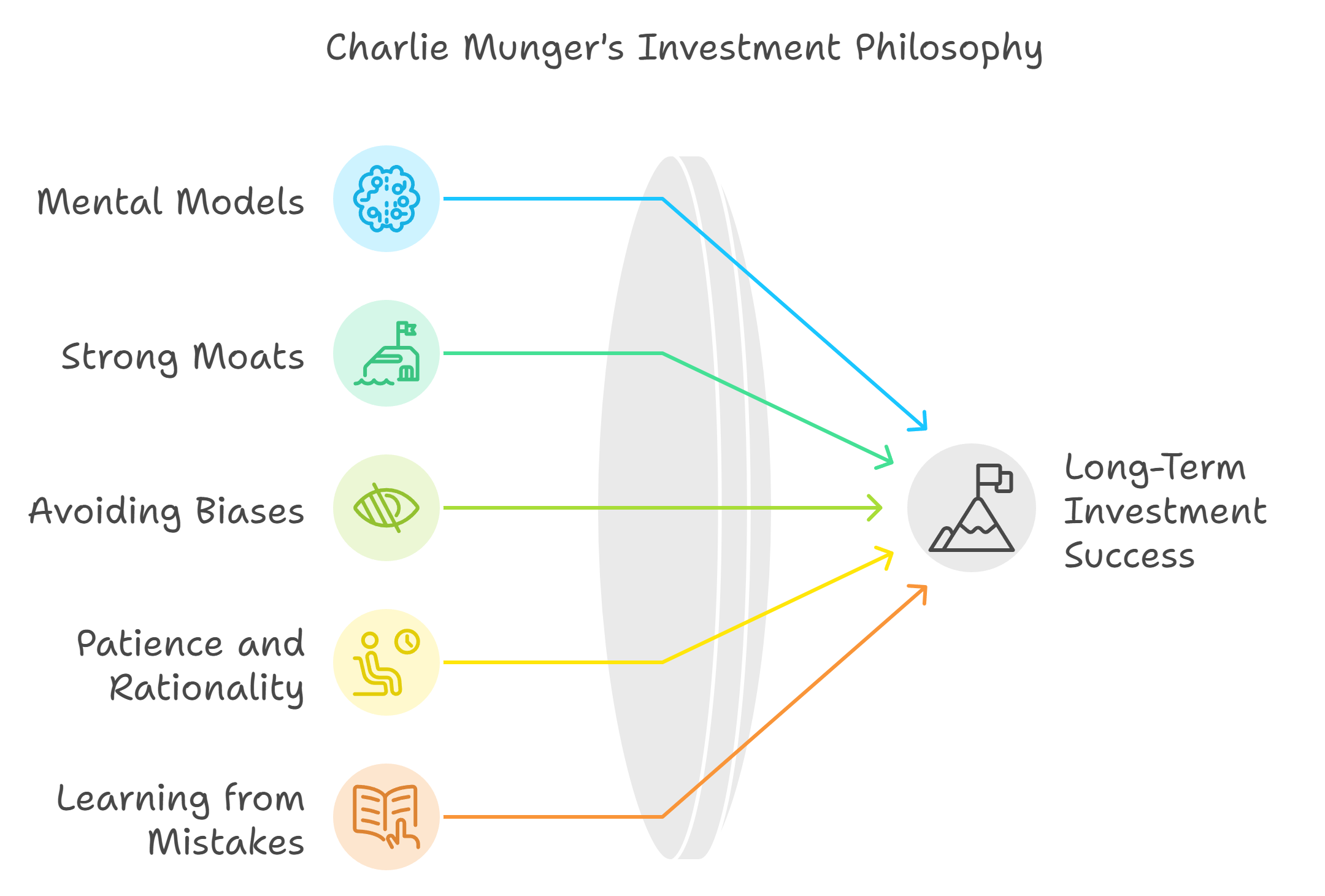

Charlie Munger, Warren Buffett’s business partner and vice-chairman of Berkshire Hathaway, is known for his deep thinking, practicality, and unique investment approach. His philosophy goes beyond just buying undervalued stocks — it’s about understanding human behavior, thinking in terms of mental models, and staying rational. In this blog, we’ll explore some of Munger’s key principles and how they can help you make better long-term investment decisions.

1. The Power of Mental Models

One of Munger’s most powerful concepts is his use of mental models — frameworks that help you understand how the world works. He believes in having a wide range of mental models from various disciplines (economics, psychology, physics) to make better investment decisions.

- Interdisciplinary Thinking: Munger advocates for learning and applying concepts from different fields to gain a broader perspective. Understanding psychology, for example, helps you avoid emotional pitfalls that derail investors.

- Example: A mental model like “opportunity cost” helps investors consider what they are giving up by choosing one investment over another, ensuring that their choices are rational and well thought out.

2. Investing in Companies with Strong Moats

Like Warren Buffett, Munger emphasizes the importance of investing in companies with strong competitive advantages or “moats.” Companies with moats have unique strengths that protect them from competitors, allowing them to maintain profitability and growth.

- Examples of Moats: Strong brands, economies of scale, network effects, and unique products can all be moats that protect a company’s position in the market.

- Why It Matters: Companies with a sustainable competitive advantage are less likely to face severe downturns, making them ideal for long-term investments. This stability translates into reliable growth and reduces risk for the investor.

3. Avoiding Psychological Biases

Munger is well-known for his understanding of human psychology and how it affects investing. He believes that recognizing and avoiding common biases can significantly improve investment outcomes.

- Examples of Biases:

- Confirmation Bias: Seeking out information that supports your beliefs while ignoring conflicting evidence.

- Loss Aversion: Fearing losses more than valuing gains, which often leads to poor decision-making.

- How to Overcome Biases: Munger recommends being aware of these biases and practicing rational detachment—making decisions based on facts, not emotions. Understanding human behavior and applying logical thinking helps avoid pitfalls that most investors fall into.

4. Patience and Rationality

Munger has often stressed that patience and rationality are crucial for successful investing. The ability to wait for the right opportunities, rather than jumping at every chance, is a hallmark of Munger’s strategy.

- Why Patience Matters: Munger’s approach is about waiting for opportunities that are “clear and easy.” This means being okay with doing nothing if there are no attractive investments, rather than chasing after mediocre opportunities.

- Example: Munger once waited years to invest in a company until the valuation was favorable. This patience allowed him to maximize returns while avoiding undue risk.

5. Learning from Mistakes

Munger often says that you learn more from your mistakes than your successes. He has publicly discussed his investment errors and used them as opportunities for growth. Learning from mistakes and improving your decision-making process is a critical part of Munger’s investment philosophy.

- Why It’s Important: Admitting mistakes and analyzing why they happened helps you avoid making the same errors again. Munger believes in being brutally honest with yourself and learning continuously.

- Example: Instead of ignoring past missteps, Munger often uses them as case studies to educate others on what not to do — whether it’s investing in the wrong business or misjudging market conditions.

Charlie Munger’s approach to long-term investing is based on rationality, patience, a deep understanding of human behavior, and using a multidisciplinary approach to make informed decisions. By following Munger’s principles—building mental models, recognizing biases, staying rational, and being patient—you can develop a more disciplined investment strategy that stands the test of time.

Interested in applying these principles to your investments? Use ValueIt to explore investment opportunities and analyze companies with strong competitive advantages, so you can start building your wealth the Munger way.