Table of Contents

Introduction

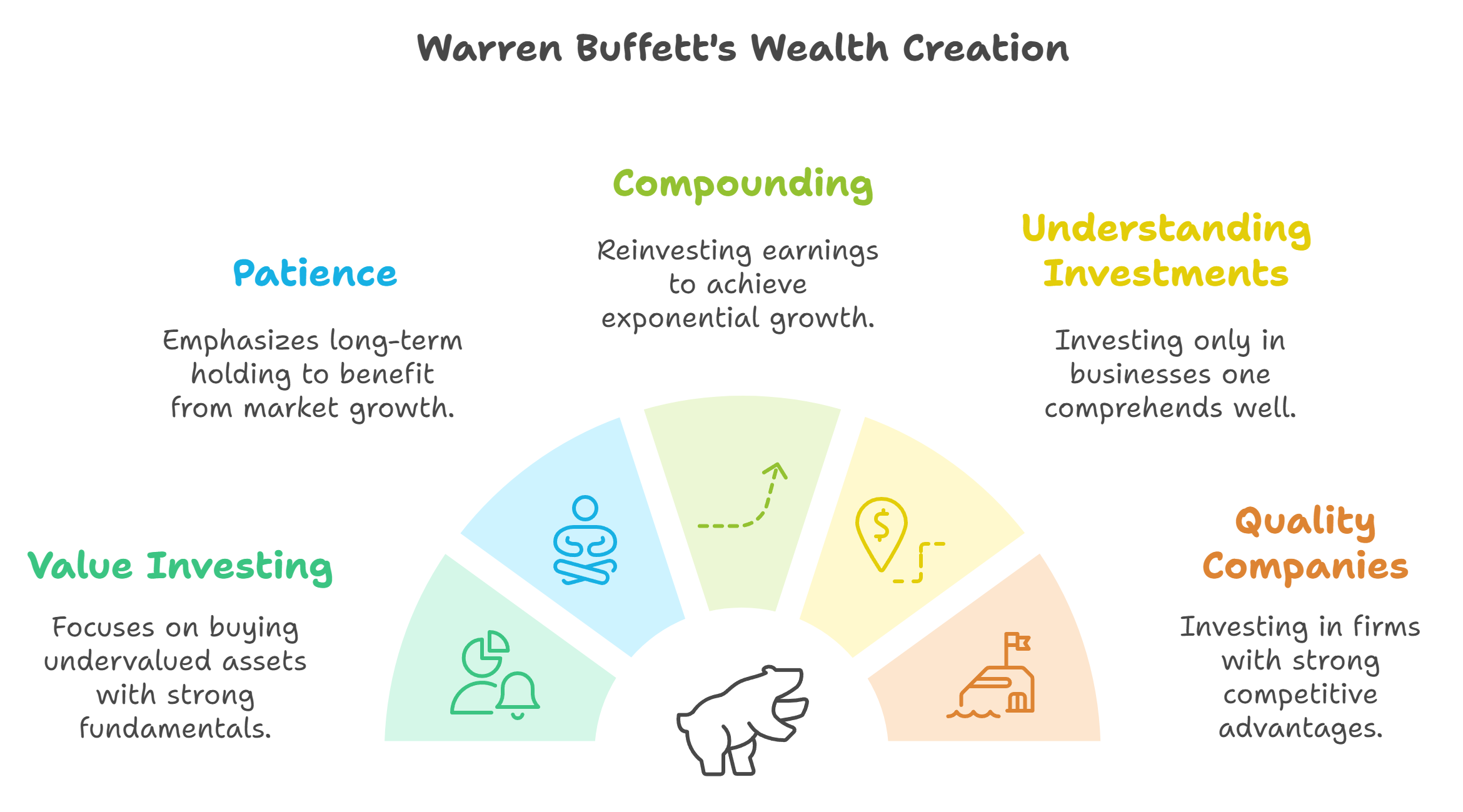

Warren Buffett, often called the “Oracle of Omaha,” is one of the most successful investors in the world. His philosophy centers on simplicity, value, and a long-term approach. In this blog, we’ll explore some of Buffett’s key principles for wealth creation that can help any investor build a strong foundation for their portfolio.

1. Focus on Value, Not Price

Warren Buffett is famous for being a value investor, which means he focuses on buying assets that are priced below their intrinsic value. Rather than getting caught up in short-term price movements, Buffett emphasizes understanding the actual worth of a company.

- How to Identify Value: Look for companies with strong fundamentals, such as consistent earnings, a competitive advantage, and a good management team. The goal is to buy when the market undervalues these assets, allowing you to benefit from their growth over time.

- Example: Buffett invested in Coca-Cola during a period when its stock price was low relative to its earnings and brand value. Today, Coca-Cola is one of his largest and most profitable holdings.

2. Patience Pays Off

Buffett’s long-term success is largely due to his patience. He often says, “The stock market is a device for transferring money from the impatient to the patient.” By holding investments for the long term, Buffett takes advantage of market growth, compounding, and the recovery potential after downturns.

- Staying the Course: Buffett’s strategy involves buying stocks with the intention of holding them “forever,” as long as the fundamentals remain strong. Instead of reacting to market volatility, he trusts in the growth of well-selected companies.

- Example: Buffett held onto his investment in American Express through periods of market panic, and eventually, the company’s stock recovered and continued to grow, making the investment highly successful.

3. The Power of Compounding

Compounding is a central concept in Buffett’s strategy. Instead of taking profits early, he reinvests his earnings to generate more returns. This “snowball effect” leads to exponential growth, especially over long periods.

- Start Early and Stay Consistent: Compounding works best when you start investing early and let your investments grow over time. Buffett himself started investing at age 11 and has benefited from decades of compounding growth.

- Illustrative Example: Imagine investing $10,000 in a stock that grows at 8% annually. After 30 years, your investment would grow to more than $100,000 due to the power of compounding.

4. Understand What You’re Investing In

Buffett believes in only investing in companies that you understand. This means having a clear idea of how the company makes money, its business model, and the risks it faces. He avoids investing in industries or technologies that are too complex or difficult to predict.

- Circle of Competence: Buffett’s concept of a “circle of competence” encourages investors to stay within the industries they understand well. This reduces the risk of making uninformed decisions and allows you to assess value more accurately.

- Example: Buffett avoided the technology sector for many years because he didn’t feel confident about understanding the products and market dynamics. Instead, he focused on consumer goods and financial services, which he could easily analyze.

5. Invest in Quality Companies with Strong Moats

A moat refers to a company’s ability to maintain its competitive advantage over time. Buffett looks for companies with strong moats, meaning they have something that protects them from competitors — such as a strong brand, unique product, or network effects.

- What to Look For: Companies with recognizable brands, economies of scale, or other differentiators that give them an edge in the market tend to be good long-term investments. These moats protect their profitability and increase the likelihood of stable growth.

- Example: Buffett’s investment in Apple is a great example of this strategy. Apple’s strong brand, loyal customer base, and unique ecosystem create a moat that has helped it maintain a leading position in the tech industry.

Warren Buffett’s secrets to long-term wealth creation are grounded in simplicity, discipline, and understanding. By focusing on value, practicing patience, leveraging the power of compounding, understanding investments, and choosing companies with strong moats, you can build a solid foundation for financial success. Remember, long-term wealth creation isn’t about getting rich overnight — it’s about making informed decisions, staying committed, and letting time do the work.

Are you ready to put these principles into practice? Use ValueIt to research and track high-quality investments that align with your financial goals. Let’s grow your wealth, one smart investment at a time.