Table of Contents

Introduction

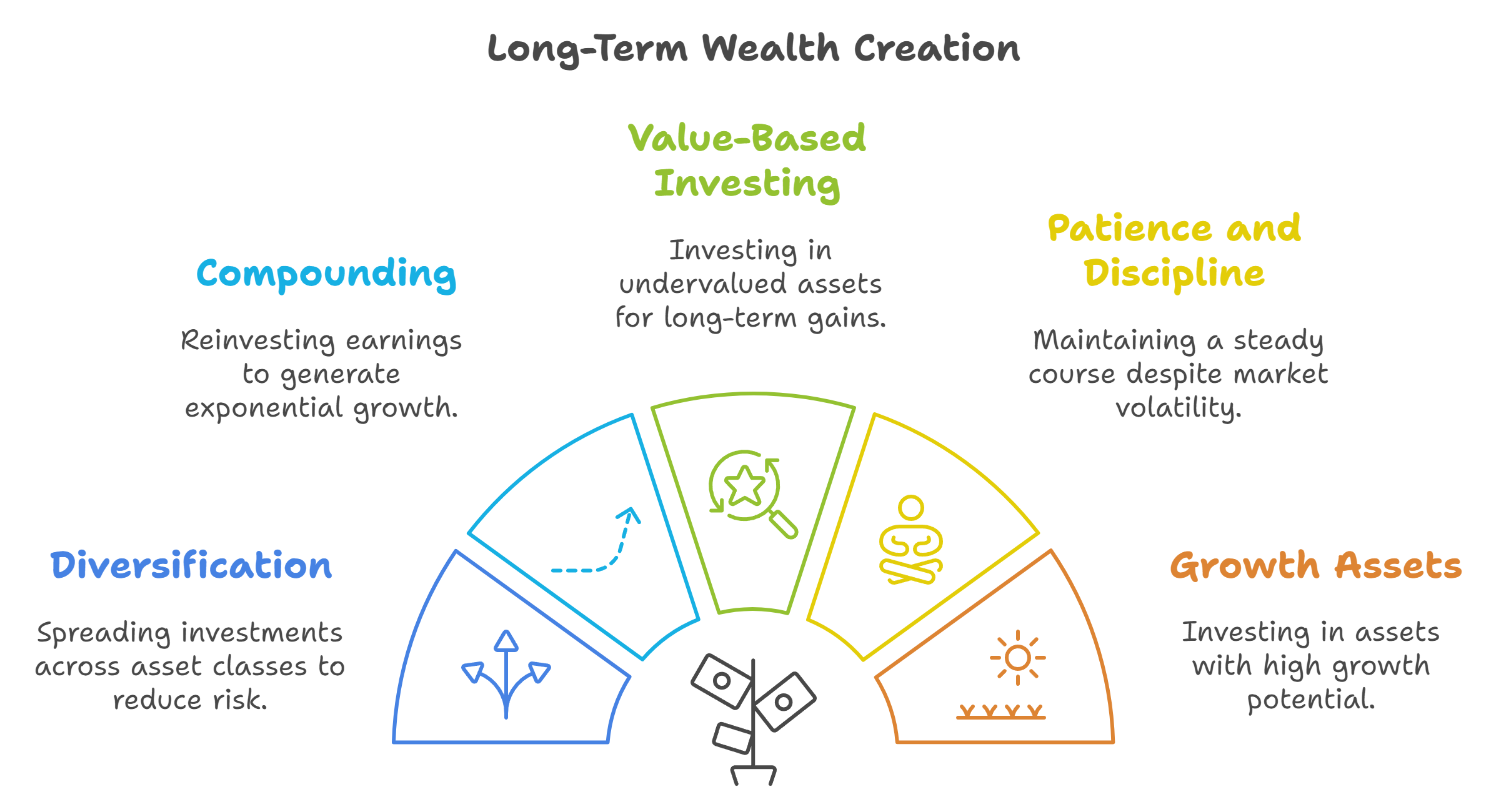

Building wealth takes time, discipline, and the right strategies. Unlike the allure of quick gains, long-term wealth creation focuses on steady growth, patience, and leveraging smart investment principles. In this blog, we’ll explore five key strategies that can help you create and grow wealth for the future.

Diversification

Diversification is the golden rule of long-term investing. It means spreading your investments across different asset classes — such as stocks, bonds, real estate, and even alternative investments like commodities — to reduce risk. The idea is that if one type of asset underperforms, the others can balance it out, protecting your portfolio from severe losses.

- How to Diversify: A well-diversified portfolio may include stocks from different industries, bonds with various maturities, and real estate holdings. If one sector struggles, the other sectors can potentially offset the losses, providing stability over the long term.

- Real-Life Example: Imagine investing all your money in technology stocks right before a market downturn. By diversifying into bonds or other sectors, you can protect your overall wealth even if one area experiences volatility.

Compounding Through Reinvestment

Compounding is one of the most powerful forces in long-term wealth creation. It involves reinvesting your earnings so that they generate additional returns. While we won’t discuss traditional interest here, compounding also occurs when you reinvest dividends from stocks or reinvest rental income into additional properties.

- How It Works: Imagine you invest in a stock that pays annual dividends. By reinvesting those dividends instead of spending them, you allow your investments to grow exponentially over time. Compounding works best when you start early and remain consistent.

- Illustrative Example: If you invest $10,000 and earn an average annual return of 8%, in ten years, your investment could grow to more than $21,000. That’s the power of compounding returns working for you.

Value-Based Investing

Value-based investing is about finding assets that are priced below their true worth and holding onto them until they reach or exceed their potential value. This approach requires patience and a focus on the long term, rather than trying to profit from short-term market fluctuations.

- The Core Idea: Look for investments that offer solid fundamentals — such as strong cash flow, steady growth, and good management — but are currently undervalued by the market. By buying when others are ignoring these assets, you position yourself for gains when the market recognizes their true value.

- Real-Life Insight: Many successful investors have used value investing to build wealth. It’s about understanding what makes a company valuable and waiting for the market to appreciate it.

Patience and Emotional Discipline

Patience is one of the hardest but most important skills in long-term wealth creation. Markets move up and down, but staying the course and not letting emotions dictate your decisions is crucial. Successful investors understand that short-term volatility is part of the journey and remain committed to their long-term strategy.

- Why It Matters: Emotional reactions like panic selling or chasing quick profits can derail even the best-laid plans. Sticking to your strategy, especially during market downturns, allows you to benefit when the market rebounds.

- Tip for Staying Disciplined: Automating your investments through monthly contributions or using robo-advisors can help you maintain consistency without the stress of daily market monitoring.

Investing in Growth Assets

Growth assets such as stocks, real estate, and even your own skills and education are key to building wealth over time. Growth assets tend to provide higher returns compared to safer, low-risk investments, and they help your wealth grow faster.

- What Are Growth Assets?: Growth assets include shares of high-quality companies, properties with appreciation potential, and other assets expected to increase in value over time. The focus here is on growth, even if it involves some short-term risk.

- Real-Life Insight: Investing in growth doesn’t necessarily mean high risk. It’s about choosing assets that show potential for long-term growth while balancing the risk with more stable investments, like bonds or cash reserves.

Long-term wealth creation is all about discipline, smart strategies, and allowing time to work in your favor. By diversifying, reinvesting your earnings, focusing on value, practicing emotional discipline, and investing in growth assets, you can set yourself up for lasting financial success. The key is to start early, stay consistent, and always think with a long-term perspective.

If you’re ready to explore how these strategies can work for you, consider using ValueIt to analyze and track potential long-term investments. Let’s build wealth for the future, one step at a time.