Table of Contents

Introduction

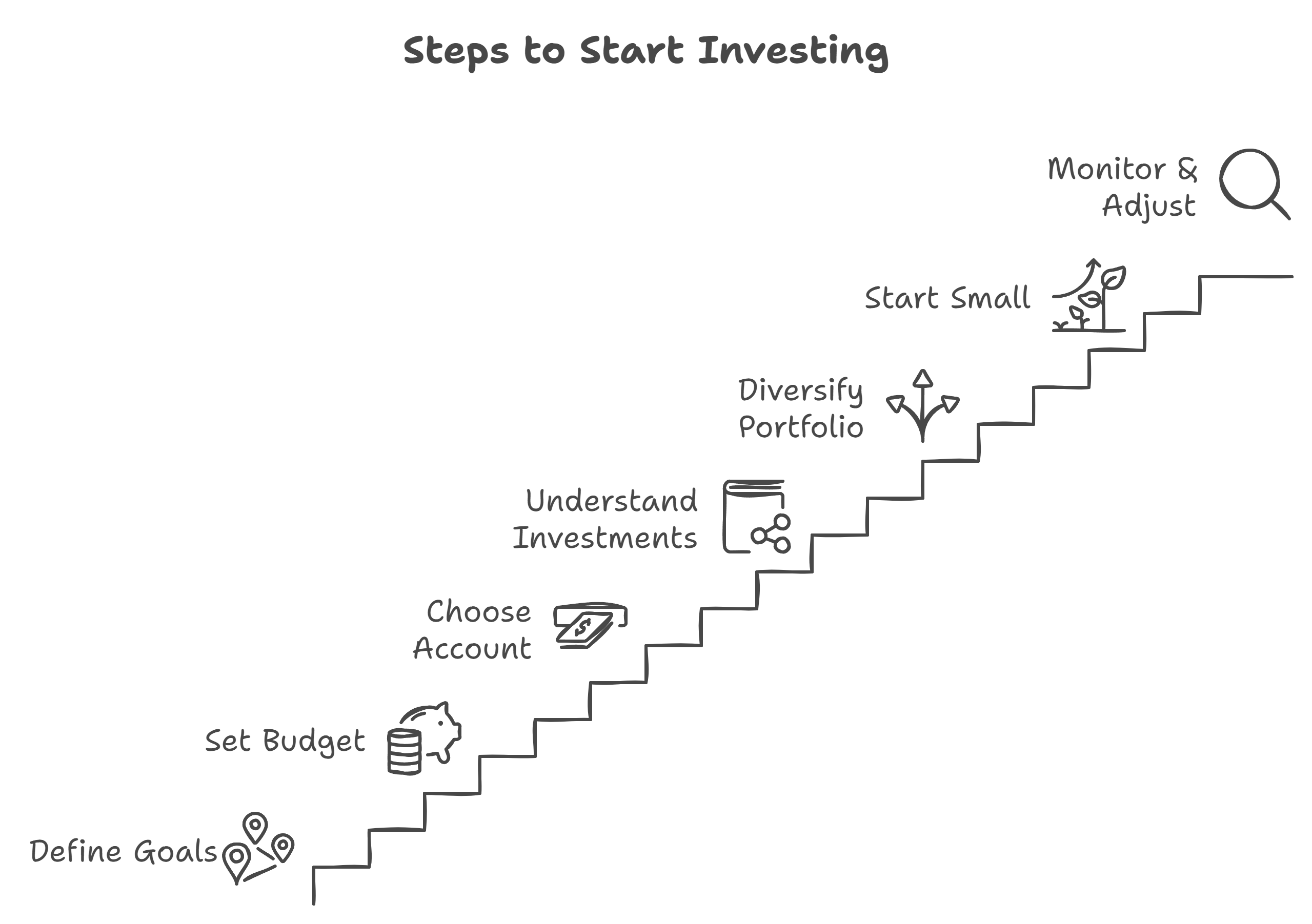

You’ve heard that investing is one of the best ways to grow your wealth, but where do you actually start? Getting started with investing might seem intimidating, with so many options, terms, and strategies. But the truth is, taking the first step is easier than you think, especially if you break it down into smaller, manageable actions. In this blog, we’ll walk you through a step-by-step guide to start your investment journey, providing you with the confidence you need to begin.

Define Your Goals

Before putting your money into anything, it’s important to define your goals. Are you investing to buy a house in ten years, fund your retirement, or save for a child’s education? Knowing what you’re investing for will help you choose the right strategy.

- Short-Term Goals:

If your goal is within the next 3-5 years, such as buying a car or taking a dream vacation, consider safer investments like bonds or high-yield savings accounts. These are less volatile and help preserve capital. - Long-Term Goals:

For long-term goals, such as retirement, growth investments like stocks or real estate are more suitable. They carry higher risk but offer better potential for growth over time.

Example:

John is 30 years old and wants to retire comfortably by age 60. His long-term goal is to build a substantial retirement fund. This goal gives John a 30-year time horizon, meaning he can afford to take on more risk and invest in growth assets like stocks.

Set Your Budget

Once you have clear goals, determine how much you can set aside for investing each month. This is your investment budget.

- Determine an Amount You Can Consistently Invest:

You don’t need a huge amount to start investing. Even small amounts can grow significantly over time thanks to compounding. Start with what you can afford, whether it’s $50 or $500 per month, and be consistent. - Avoid Overcommitting:

Ensure your emergency savings are in place before committing too much to investments. Ideally, you should have 3-6 months’ worth of living expenses saved up for emergencies.

Example:

If Emily wants to invest $200 per month, she sets up an automatic transfer from her checking account to her brokerage account every month. This consistent investing habit helps her build wealth over time.

Choose an Investment Account

There are different types of accounts you can use to start investing. Choosing the right one depends on your goals:

- Brokerage Accounts:

A brokerage account allows you to buy and sell a variety of investments, such as stocks, ETFs, and bonds. It’s flexible and has no contribution limits, making it a good option for general investing. - Retirement Accounts:

If your goal is retirement, consider opening an Individual Retirement Account (IRA) or contributing to a 401(k). These accounts offer tax advantages, but they also have restrictions on when you can withdraw funds. - Robo-Advisors:

If you’re new to investing and want help managing your portfolio, consider using a robo-advisor. Robo-advisors use algorithms to create and manage a diversified portfolio for you, making it easier for beginners.

Example:

Sarah opens a brokerage account to start building wealth for future goals, but she also contributes to her company’s 401(k) to take advantage of employer matching — a great way to boost her retirement savings.

Understand Different Types of Investments

It’s important to understand the main investment options available:

- Stocks:

When you buy stocks, you’re purchasing shares of ownership in a company. Stocks have high growth potential, but they also come with higher risk compared to other investments. - Bonds:

Bonds are loans to companies or governments. In return for lending your money, you receive interest payments over a fixed period. Bonds are generally considered safer but provide lower returns. - Mutual Funds and ETFs:

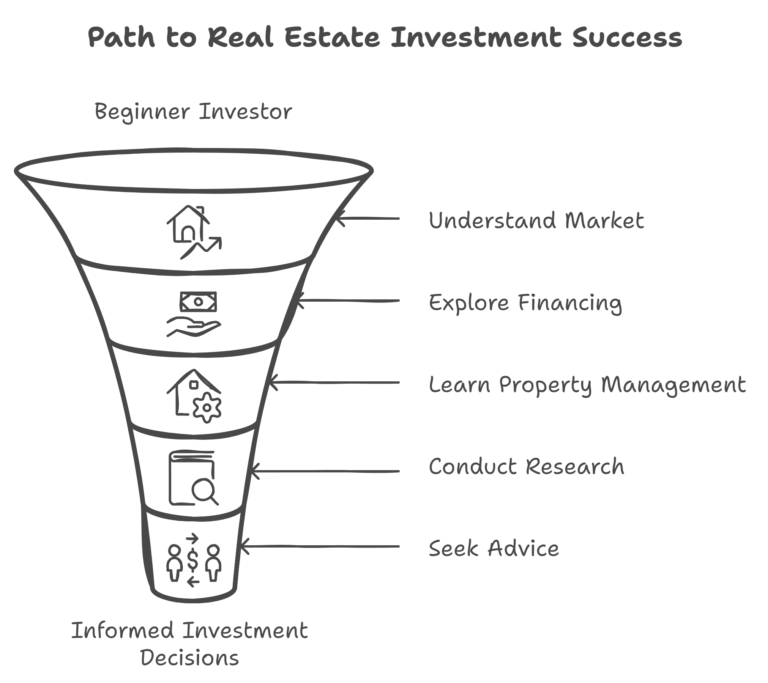

Mutual funds and Exchange-Traded Funds (ETFs) pool money from many investors to invest in a diversified portfolio of assets. They are great options for beginners who want diversification without having to buy individual stocks. - Real Estate:

Investing in real estate involves buying properties, either directly or through Real Estate Investment Trusts (REITs). It’s a great way to diversify your portfolio and generate income.

Example:

Michael decides to invest in ETFs because they provide instant diversification and are easier to manage compared to buying individual stocks.

Diversify Your Investments

Diversification is a strategy that helps reduce risk by spreading your investments across different assets. It ensures that you don’t have all your eggs in one basket, protecting you if one investment doesn’t perform well.

- Why Diversification Matters:

If you invest only in tech stocks and that sector experiences a downturn, your entire portfolio will take a hit. By diversifying — investing in a mix of stocks, bonds, and real estate—you reduce the risk of a significant loss. - How to Diversify:

- Invest in different industries (e.g., healthcare, technology, finance).

- Consider a mix of stocks, bonds, and real estate.

- Use ETFs or mutual funds to gain exposure to a broad range of assets.

Example:

Anna diversifies her portfolio by investing in a mix of technology ETFs, government bonds, and real estate REITs. This way, if one industry struggles, her other investments can help balance her returns.

Start Small and Be Consistent

You don’t need a large sum of money to start investing. The key is to start small and stay consistent.

- Dollar-Cost Averaging:

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy helps reduce the impact of market volatility and ensures you’re buying more shares when prices are low and fewer when prices are high. - Automatic Contributions:

Setting up automatic contributions to your investment account can help you stay disciplined and consistent in your investing journey.

Example:

Carlos uses dollar-cost averaging to invest $100 into an index fund every month. By doing this, he reduces his risk of investing a lump sum at a market peak and benefits from steady, long-term growth.

Monitor and Adjust Your Investments

Once you’ve started investing, it’s important to monitor your portfolio periodically and make adjustments as needed:

- Review Your Investments:

Set aside time every few months to review your investments. Are they performing as expected? Do they align with your goals? Make adjustments if needed. - Rebalance Your Portfolio:

Over time, some investments will perform better than others, which can throw off your desired mix of assets. Rebalancing means selling some investments and buying others to maintain your target asset allocation.

Example:

If Emily originally allocated 60% of her portfolio to stocks and 40% to bonds, but the stock market did really well, she might now have 70% in stocks. To maintain her preferred risk level, she would rebalance by selling some stocks and buying bonds to get back to 60/40.

Starting your investment journey can feel overwhelming, but breaking it down into simple, actionable steps makes it much more approachable. From defining your goals to choosing the right accounts and understanding diversification, each step brings you closer to growing your wealth and achieving financial security.

Are you ready to take the next step? Use ValueIt to analyze potential investments and start building a portfolio that aligns with your goals. Remember, successful investing is all about consistency, patience, and making informed choices. Take the first step today—your future self will thank you.