Table of Contents

Introduction

You’ve probably seen movies or heard stories about people making big profits by buying and selling stocks within a single day, this is day trading. It sounds thrilling, like a fast-paced game, but day trading is also challenging and comes with its risks. It requires quick decision-making, a deep understanding of the market, and a high tolerance for risk. In this blog, we’ll introduce you to day trading, explore how it works, and help you decide if it might be a good fit for you.

What is Day Trading?

Day trading is an investment strategy where traders buy and sell financial instrument, such as stocks, within the same trading day. The goal is to profit from small price movements that occur throughout the day.

- Fast-Paced Nature: Unlike long-term investing, where you hold on to stocks for years, day traders open and close their positions within hours or minutes. They do not hold positions overnight, which helps reduce exposure to unexpected risks that can happen after the market closes.

- Instruments Used in Day Trading:

While stocks are the most popular asset for day trading, other instruments like forex (foreign exchange), futures contracts, and cryptocurrencies are also common.

Example: A day trader might buy 100 shares of a company at $20 each and sell them an hour later for $21 each. That $1 difference per share is their profit, minus any fees or costs.

How Day Trading Works

Day trading is based on making quick decisions based on market movements. Here’s a step-by-step look at how it typically works:

- 1. Market Research and Analysis:

Day traders spend hours researching companies, looking at news, and studying charts. Technical analysis, which involves using charts and patterns to predict price movements, is a key tool for day traders. - 2. Setting Up Your Trade:

Day traders look for entry points, the right moment to buy a stock. They might use indicators such as moving averages or support and resistance levels to identify when the price might go up or down. - 3. Executing Trades Quickly:

Once they identify an opportunity, day traders need to act fast. They often use trading platforms with high-speed execution to avoid missing a favorable price. - 4. Managing Risk:

Successful day traders set stop-loss orders to automatically sell a position if the price drops below a certain point, helping to limit potential losses.

Tools and Skills Required for Day Trading

Day trading is not for the faint of heart. Here’s what you need if you’re considering giving it a shot:

- 1. A High-Quality Trading Platform:

Fast execution is crucial for day traders, so you’ll need a trading platform that provides real-time data and swift execution of trades. - 2. Technical Analysis:

Day traders rely on technical indicators such as moving averages, relative strength index (RSI), and Bollinger Bands to make their decisions. Learning how to read these charts is essential. - 3. Risk Management Skills:

Day trading is high risk. Knowing how to set stop-loss limits, how much of your portfolio to allocate to each trade, and when to walk away are vital skills for managing risk. - 4. Emotional Discipline:

Day trading can be very emotional. Prices fluctuate, and the fear of losing money or the greed for more profit can lead to bad decisions. Successful day traders learn to manage their emotions and stick to their strategy.

Day Trading vs. Long-Term Investing

It’s important to understand the differences between day trading and long-term investing so you can determine which approach aligns better with your goals and lifestyle:

Day Trading:

- Short Time Frame: Trades are completed within minutes or hours.

- High Risk and High Reward: The potential for profit is there, but losses can add up just as fast.

- Skill-Intensive: Requires continuous monitoring of the market, deep understanding of technical indicators, and a lot of practice.

Long-Term Investing:

- Long Time Frame: Investors hold assets for years or decades.

- Less Stressful: Short-term price fluctuations are less concerning since the focus is on long-term growth.

- Builds Wealth Over Time: Benefits from compounding returns and historically stable growth.

Example:

- Day Trader: James buys a stock at $50 in the morning and sells it for $55 a couple of hours later. He makes a $5 per share profit but spent the whole day monitoring market news and charts.

- Long-Term Investor: Sarah buys the same stock at $50 and holds it for 10 years. Over the years, the stock appreciates and pays dividends, growing to $150. Sarah earns both from price appreciation and dividends, with a lot less stress.

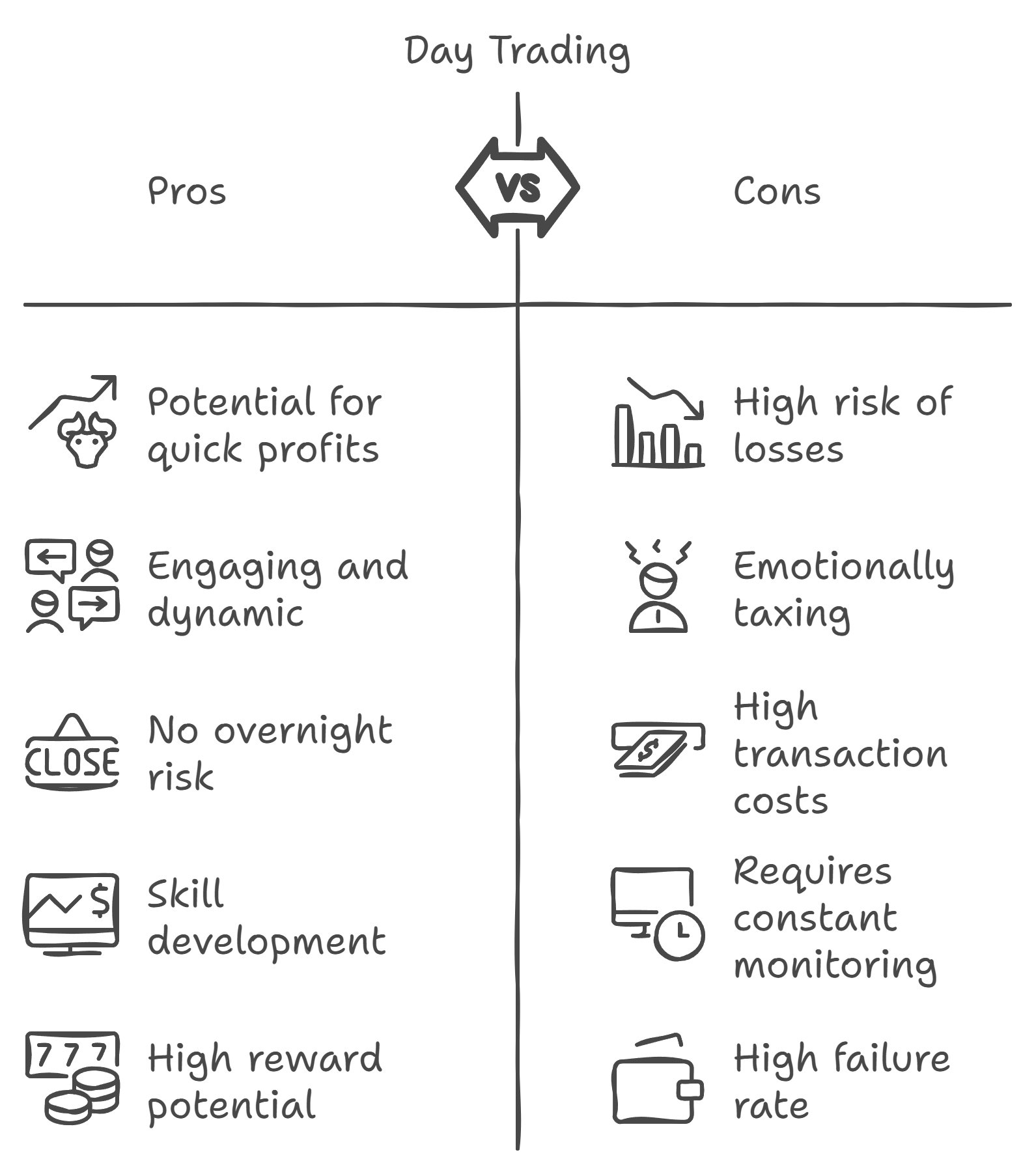

Risks Involved in Day Trading

Day trading isn’t without its risks, and understanding them is key to deciding if it’s right for you.

- 1. Market Volatility:

Prices can change in seconds, and even small movements can lead to significant gains or losses. News events, economic data, or even social media posts can cause prices to fluctuate rapidly. - 2. Emotional Toll:

The fast-paced nature of day trading can be mentally exhausting. If trades go wrong, it can lead to emotional decision-making, causing traders to hold onto losing positions or make irrational trades. - 3. High Transaction Costs:

Each trade you make comes with fees or commissions. Frequent buying and selling can quickly add up, eating into your profits. - 4. High Failure Rate:

The reality is that most beginner day traders lose money. Without sufficient knowledge, practice, and emotional discipline, the chances of success are low.

Is Day Trading Right for You?

Day trading might sound exciting, but it’s not suitable for everyone. Ask yourself:

- Do I Have the Time?

Day trading requires constant monitoring and decision-making. It’s a full-time activity rather than a passive investment strategy. - Am I Comfortable Taking Risks?

Day trading involves high levels of risk. You could lose a significant portion of your money if trades don’t go your way. - Do I Enjoy the Fast Pace?

Day trading isn’t just about making money, it’s about enjoying the challenge of reading the market, making quick decisions, and acting under pressure.

If your goal is to make steady, long-term gains without spending hours each day watching charts, day trading might not be for you. Instead, long-term investing can help you grow wealth more steadily with less stress.

Day trading can be an exhilarating way to engage with the stock market, but it comes with significant risks and challenges. It’s important to understand that it’s not a shortcut to easy money—it requires skill, discipline, and the ability to manage your emotions. If you’re not ready for the risks and want a more stable approach, long-term investing is a safer and more rewarding path to financial growth.

Looking for a way to build your wealth over time without the stress of day trading? Use ValueIt to explore long-term investments that align with your financial goals. Take a more relaxed approach to investing and benefit from the steady growth that long-term strategies can offer.