Table of Contents

Introduction

If you’ve ever heard people talk about the stock market, you might imagine a chaotic room with traders shouting and waving papers. The reality is a lot different, and much simpler. The stock market is a place where people buy and sell ownership stakes in companies, but what does that really mean? How does it all work? In this blog, we’ll break down the basics of the stock market, explain how it works, and help you understand why it’s an essential tool for building wealth.

What is the Stock Market?

The stock market is a collection of exchanges where investors can buy and sell shares of publicly traded companies. When you buy a share, you’re buying a small part of that company — essentially becoming a partial owner.

- Major Stock Exchanges:

In the U.S., the main stock exchanges are the New York Stock Exchange (NYSE) and NASDAQ. Think of these exchanges like markets where people meet to trade company shares. - Why Companies List on the Stock Market:

Companies list their shares on the stock market to raise money. For example, a growing company might need capital to build a new factory, expand operations, or develop new products. By selling shares, they can get the funds they need, while investors get a chance to share in the company’s success.

Example: When Apple went public in 1980, it allowed ordinary people to buy shares of the company. Those who invested back then have seen the value of their shares grow tremendously.

How Does the Stock Market Work?

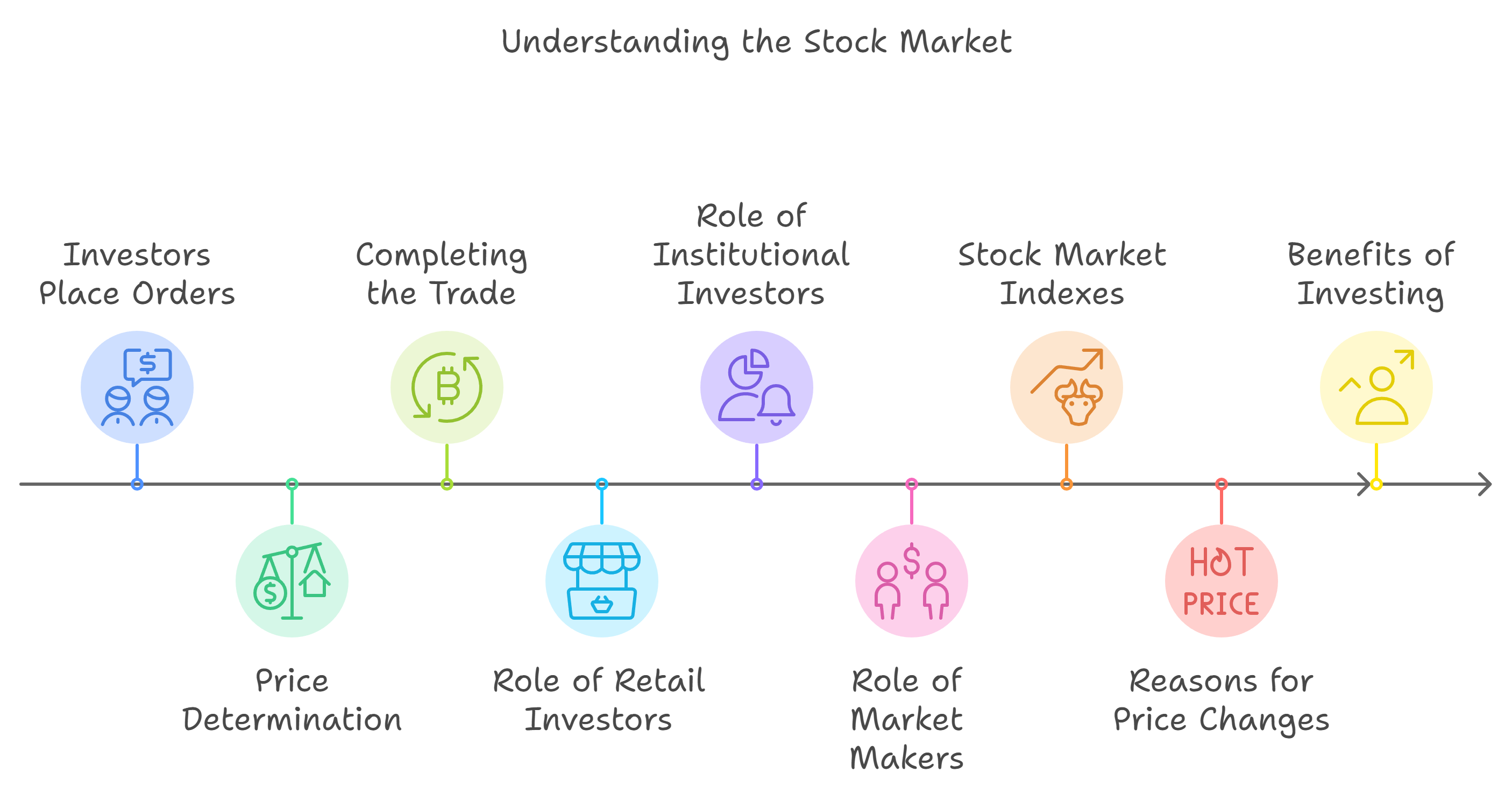

The stock market works like an auction, where buyers and sellers come together to agree on a price for a stock. Here’s how it works step-by-step:

- 1. Investors Place Orders:

Investors place orders to either buy or sell shares through a broker. A broker acts as a middleman between you and the stock exchange. Today, most of this happens electronically. - 2. Price Determination:

The price of a stock is determined by supply and demand. If more people want to buy a stock (demand) than sell it (supply), the price goes up. If more people want to sell, the price goes down. - 3. Completing the Trade:

Once a buyer and seller agree on a price, the trade happens. The shares move from the seller’s account to the buyer’s account, and money moves in the opposite direction.

Analogy: Imagine a farmer’s market. If everyone wants apples but there are only a few left, the price of apples will increase. Similarly, in the stock market, prices are driven by how much people want to buy or sell shares.

Key Players in the Stock Market

The stock market involves many different participants. Here’s a look at the main players:

- Retail Investors:

People like you and me who buy stocks for our personal investment portfolios. - Institutional Investors:

Large organizations like hedge funds, pension funds, and mutual funds that trade massive volumes of shares. They often have a significant impact on stock prices because of the size of their trades. - Market Makers:

These are firms that help maintain liquidity in the market by being ready to buy or sell shares at any given time. They “make the market” by ensuring that there are always buyers and sellers, which keeps the market running smoothly.

Example: If you place an order to buy a stock, but there are no immediate sellers, a market maker might step in to sell it to you to ensure the trade goes through.

Stock Market Indexes

A stock market index is a tool used to measure the overall performance of a group of stocks. Think of it like a report card for the stock market or a specific sector.

- Popular Stock Market Indexes:

- S&P 500: Tracks the performance of 500 of the largest publicly traded companies in the U.S. It’s often used as a benchmark for how the entire U.S. market is performing.

- NASDAQ Composite: Includes all the stocks listed on the NASDAQ exchange, with a strong focus on technology companies.

- Dow Jones Industrial Average (DJIA): Represents 30 large, well-established companies. It’s one of the oldest and most well-known indexes.

Example: If you hear that “the S&P 500 is up today,” it means that the average value of the 500 companies in the index has increased, indicating a positive market trend.

Why Do Stock Prices Change?

Stock prices fluctuate constantly, and there are a few key reasons why:

- Company Performance:

Positive earnings reports or new product launches can drive a company’s stock price up, while negative news can cause it to drop. - Market Sentiment:

Investors’ emotions play a big role in the stock market. Optimism can drive prices up, while fear and uncertainty can drive them down. News events, global developments, and even tweets from influential people can cause stocks to rise or fall. - Supply and Demand:

As mentioned earlier, the more people want to buy a stock, the higher its price will go. Conversely, more sellers than buyers will push the price down.

Example: If a tech company announces a revolutionary new product, investors might become excited and rush to buy shares, driving up the price.

Why Should You Invest in the Stock Market?

Investing in the stock market is one of the most effective ways to grow wealth over time. Here’s why:

- Historical Growth:

The stock market has historically returned an average of 7-10% per year after inflation, making it a great option for long-term wealth creation. - Compounding:

When you reinvest your earnings, you benefit from compounding — earning returns on your returns. This can significantly grow your wealth over the years. - Ownership in Companies:

When you buy stocks, you’re buying ownership in companies. If the company does well, so do your investments.

The stock market might seem complex at first, but at its core, it’s a marketplace where buyers and sellers come together to trade ownership in companies. Understanding how it works — along with the factors that influence stock prices — will help you feel more confident when making investment decisions.

Are you ready to explore long-term investment opportunities in the stock market? Use ValueIt to analyze potential stocks and make informed decisions. With the right knowledge and tools, investing in the stock market can be a powerful way to build wealth and achieve your financial goals.