Table of Contents

Introduction

Picture this scenario: You have some savings, and you’re ready to invest. But as you start exploring your options, you see two main strategies, long-term investing and short-term investing. Which one should you choose? Do you want quick gains, or would you rather play the long game and build wealth steadily over time? Each approach has its pros and cons, and the right choice depends on your goals, time horizon, and risk tolerance. In this blog, we’ll break down the differences between long-term and short-term investing to help you decide which one suits you best.

What is Long-Term Investing?

Long-term investing is about holding investments for an extended period, typically 5 years or more. It focuses on allowing investments to grow and benefit from compounding over time, with less concern for daily market fluctuations.

- Examples of Long-Term Investments:

- Stocks: Buying shares of strong companies and holding them for years.

- Real Estate: Buying property that will appreciate over time.

- Retirement Accounts: Contributions to IRAs or 401(k)s with long-term growth potential.

- Advantages of Long-Term Investing:

- Potential for Higher Returns: Historically, long-term investors in stocks have enjoyed significant returns due to market growth.

- Less Stress: You don’t need to worry about daily market ups and downs. The focus is on the bigger picture, so short-term volatility isn’t a concern.

- Compounding: By reinvesting dividends or earnings, long-term investors benefit from compounding, which helps grow investments exponentially.

Example: If you invested $1,000 in an index fund that earns an average of 8% annually, in 20 years, that investment could grow to over $4,660 thanks to compounding.

2. What is Short-Term Investing?

Short-term investing refers to buying and selling investments within a short time frame — typically less than a year. The focus here is on taking advantage of market movements to earn quick profits.

- Examples of Short-Term Investments:

- Day Trading Stocks: Buying and selling stocks in a single day to profit from price changes.

- Bonds: Short-term government or corporate bonds with maturities of less than a year.

- Money Market Funds: A type of mutual fund investing in low-risk, short-term debt.

- Advantages of Short-Term Investing:

- Quick Gains: Short-term strategies can lead to fast profits if you buy at the right time.

- Liquidity: Many short-term investments are highly liquid, meaning you can easily access your money when needed.

Example: Let’s say you bought a stock at $50 per share, and within two weeks, it increased to $55 per share. Selling it would yield a 10% gain in just two weeks.

3. Pros and Cons of Long-Term vs. Short-Term Investing

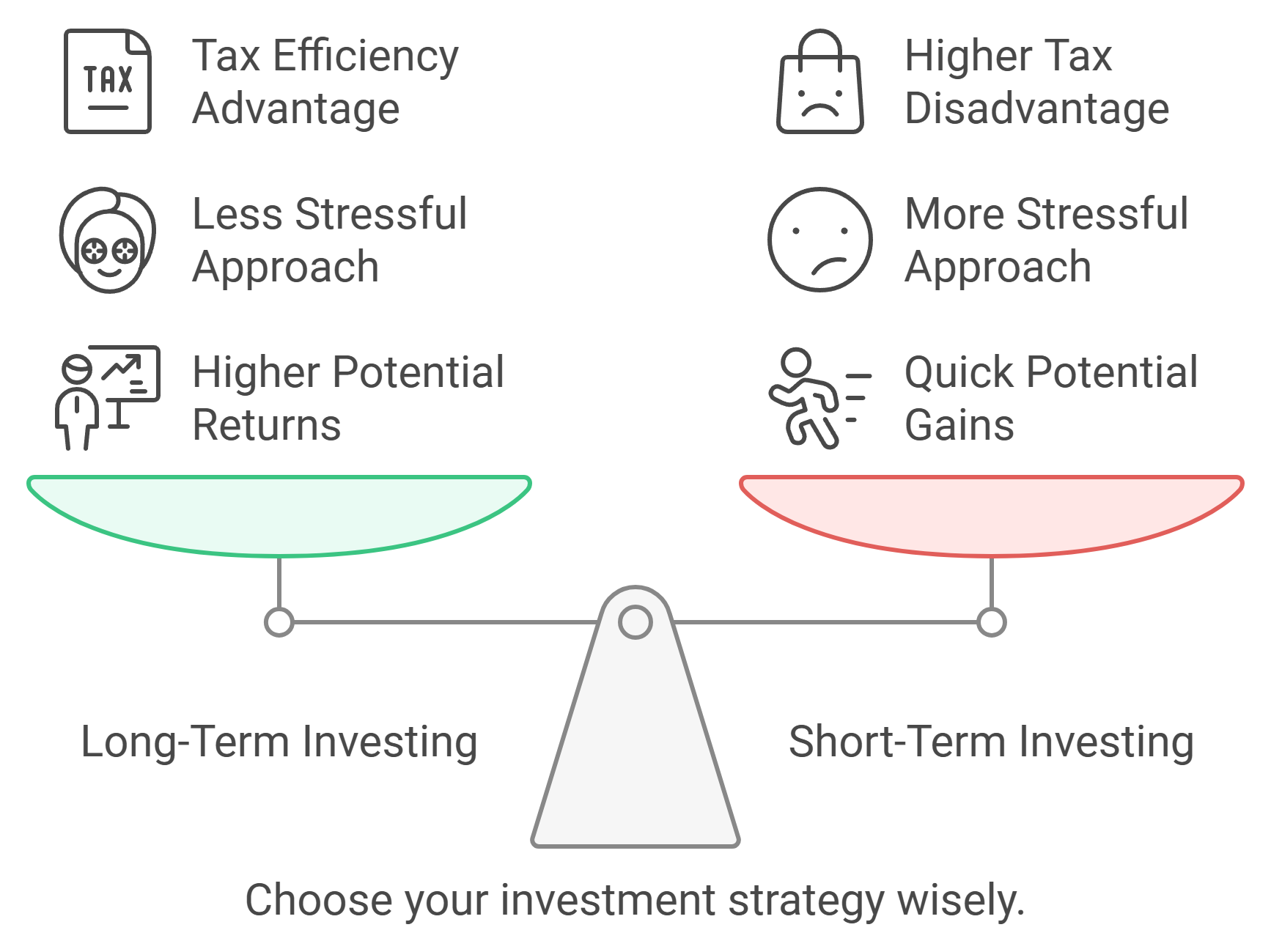

Choosing between long-term and short-term investing depends on your financial goals, personality, and risk tolerance. Here’s a detailed comparison to help you understand the strengths and weaknesses of each:

Pros of Long-Term Investing:

- Time to Recover: Markets can be volatile in the short term, but over the long term, they generally trend upwards. If a stock drops in value, a long-term investor has time to wait for it to recover.

- Tax Efficiency: Long-term investments benefit from lower tax rates on capital gains compared to short-term trades.

- Less Time-Consuming: You don’t need to monitor the market every day. Once you’ve made your investments, it’s more of a “set it and forget it” approach.

Cons of Long-Term Investing:

- Requires Patience: Results are not immediate, and it can take years before you see significant growth.

- Locked Capital: If you need money quickly, selling long-term investments might not be ideal, especially during a market downturn.

Pros of Short-Term Investing:

- Potential for High Returns in a Short Time: The opportunity to take advantage of market trends and earn money quickly.

- Liquidity: Money is not tied up for long periods. You can sell assets quickly and access funds when needed.

Cons of Short-Term Investing:

- Higher Risk: The stock market’s daily fluctuations can lead to significant losses if trades go poorly.

- Stressful: Constant monitoring of markets can be time-consuming and stressful.

- Tax Disadvantage: Short-term capital gains are taxed at a higher rate compared to long-term gains.

4. Which Strategy Suits You Best?

To determine whether long-term or short-term investing is right for you, ask yourself the following questions:

- What Are Your Goals?

If your goal is to grow your wealth for retirement or buy a house in 10 years, long-term investing is likely the best choice. But if you want to make quick gains for a near-term purchase, short-term strategies may be worth exploring. - How Much Risk Are You Comfortable With?

Short-term investing carries greater risk, as it’s influenced by market volatility. If you’re risk-averse and prefer a steady approach, long-term investments will suit you better. - How Much Time Can You Dedicate?

Short-term investing requires active involvement — research, constant monitoring, and timely decisions. If you don’t have the time to do this, then a long-term, passive investing strategy is ideal.

Example:

- Long-Term Investor: Sarah is 28 years old and wants to save for retirement. She invests regularly in an S&P 500 index fund and doesn’t worry about daily price changes.

- Short-Term Investor: John wants to earn enough in the next six months for a vacation. He invests in stocks with the goal of quick, profitable trades but is willing to accept the higher risk.

Whether you choose long-term or short-term investing depends on your financial situation, goals, and risk tolerance. Long-term investing helps you build steady wealth over time, benefiting from the power of compounding and avoiding the stress of day-to-day market swings. On the other hand, short-term investing is riskier but can offer quick gains for those who are willing to put in the time and effort.

If long-term growth is what you’re aiming for, ValueIt can help you evaluate promising investments and see how they align with your financial goals. Remember, successful investing starts with a clear understanding of what you want to achieve.

Explore ValueIt’s platform to take your first steps toward a successful investment journey.