Table of Contents

Introduction

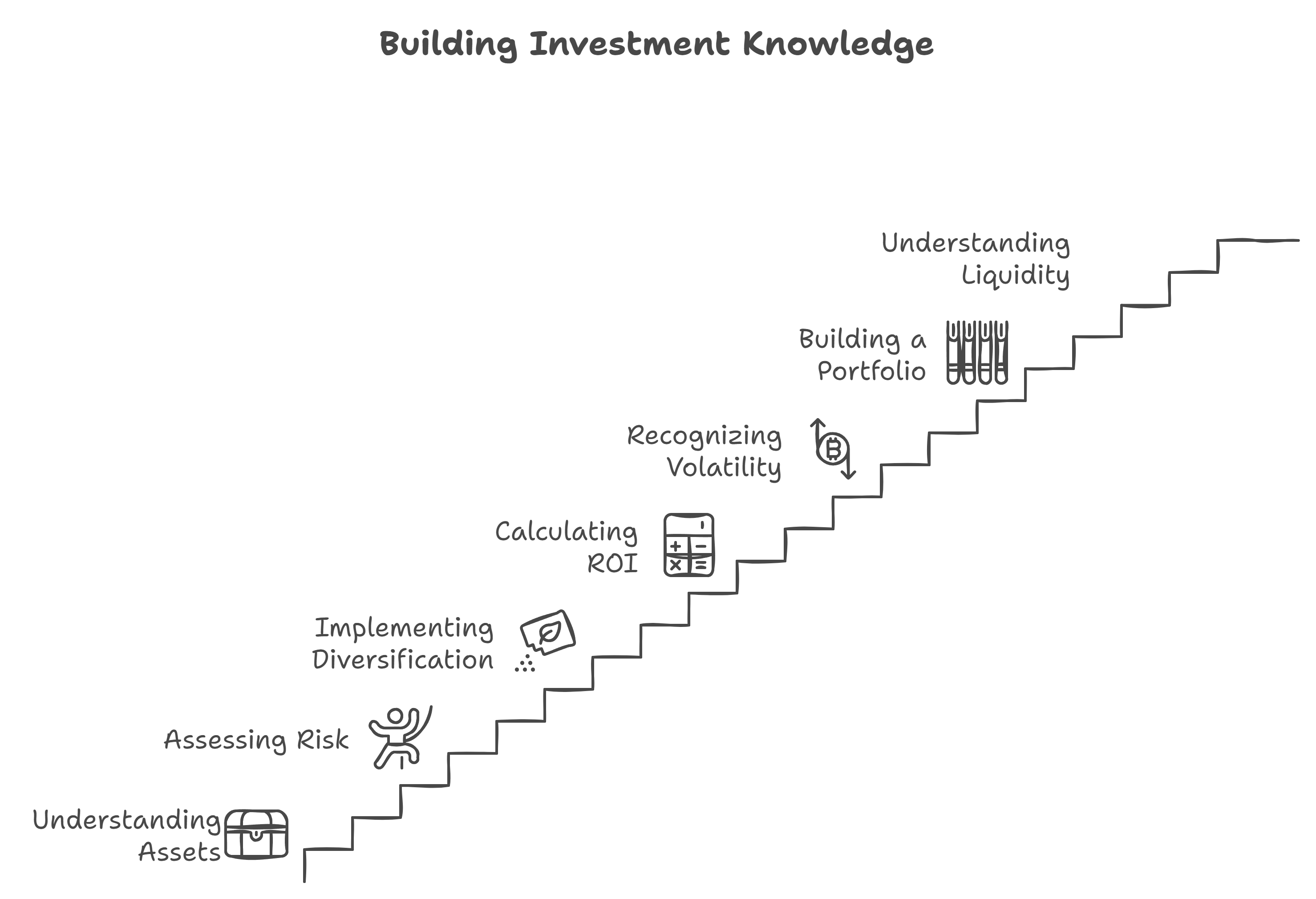

Picture this: You’ve decided to start investing, but every time you read an article or hear someone talk about investing, it feels like a completely different language. Terms like “diversification,” “liquidity,” and “compounding” are thrown around, and you wonder, “How can I ever keep up?” The good news is that these concepts are much easier to understand than they first appear.

In this guide, we’ll break down 10 essential investing terms you need to know as a beginner. By the end, you’ll feel more confident and ready to tackle the world of investing.

1. Asset

An asset is anything of value that you own. In the context of investing, assets could be stocks, bonds, real estate, or even cash. When you invest in an asset, your goal is for that asset to grow in value over time.

Example: If you buy a house, the house itself is an asset. If you own stocks in a company like Apple, those stocks are assets.

2. Risk

Risk is the possibility that an investment will lose value. In other words, it’s the chance that you won’t get back the money you put in — or that you might even lose more. All investments carry some level of risk, but the key is understanding how much risk you’re willing to take.

- High Risk: Potential for higher returns, but also higher chances of losses (e.g., growth stocks, cryptocurrencies).

- Low Risk: Lower potential returns but more stability (e.g., government bonds).

Knowing your risk tolerance helps you decide which investments are suitable for you.

3. Diversification

Diversification is a strategy that involves spreading your investments across different asset types or sectors to manage risk. The idea is, “Don’t put all your eggs in one basket.” By diversifying, you reduce the chance of losing everything if one investment goes south.

Example: Instead of putting all your money into tech stocks, you could diversify by investing in tech, healthcare, and energy sectors. That way, if one industry struggles, your entire portfolio isn’t affected as badly.

4. Return on Investment (ROI)

Return on Investment (ROI) is the profit or loss you make from an investment relative to the amount of money you put in. It’s usually expressed as a percentage.

- ROI Formula: (Current Value – Initial Investment) / Initial Investment x 100.

Example: If you invested $1,000 in a stock and it’s now worth $1,200, your ROI would be:

($1,200 – $1,000) / $1,000 x 100 = 20% ROI.

5. Volatility

Volatility refers to how much an investment’s value goes up and down over time. Higher volatility means larger price swings, while lower volatility means more stable prices.

- High Volatility: Stocks like Tesla, which can see big price jumps in a single day.

- Low Volatility: Bonds or blue-chip stocks that generally move more steadily.

Volatility isn’t inherently good or bad, it just helps you understand how quickly prices might change.

6. Portfolio

A portfolio is simply a collection of all your investments. It could include stocks, bonds, real estate, or other assets. The goal is to build a portfolio that aligns with your financial goals and risk tolerance.

Example: A balanced portfolio might include 60% stocks, 30% bonds, and 10% cash. This mix helps you manage risk while aiming for growth.

7. Liquidity

Liquidity is how easily you can convert an asset into cash without significantly affecting its price. Some investments are more liquid than others.

- High Liquidity: Stocks, which you can sell almost instantly during market hours.

- Low Liquidity: Real estate, which can take months or even years to sell.

The more liquid an asset is, the easier it is to access your money.

8. Dividend

A dividend is a portion of a company’s profits paid out to its shareholders. Not all companies pay dividends, but those that do are usually well-established and want to reward their investors.

Example: If you own shares of a company that pays a dividend of $2 per share annually, and you have 100 shares, you’ll receive $200 in dividends each year.

Dividends can be a great way to earn passive income, especially for long-term investors.

9. Capital Gain

Capital Gain is the profit you make when you sell an asset for more than you bought it. It’s one of the main ways investors earn money.

- Short-Term Capital Gain: Profit from selling an asset you’ve held for less than a year.

- Long-Term Capital Gain: Profit from selling an asset held for more than a year, which typically has a lower tax rate.

Example: If you bought stock for $500 and sold it for $700, your capital gain is $200.

10. Compounding

Compounding is when your earnings start to generate more earnings. It’s often called the “eighth wonder of the world” because it can significantly boost your investment growth over time.

Example: If you invest $1,000 and it earns 10% in a year, you’ll have $1,100. In the next year, you earn 10% on $1,100, which means your earnings grow on both the initial amount and the previous earnings.

The more time your money has to grow, the more powerful compounding becomes, especially for long-term investors.

Investing doesn’t have to feel like learning a new language. Understanding these key concepts is the first step toward building your confidence as an investor. Each term helps you get closer to making informed decisions that align with your financial goals.

Remember, building wealth is all about starting with a solid foundation — one term at a time.