Table of Contents

Introduction

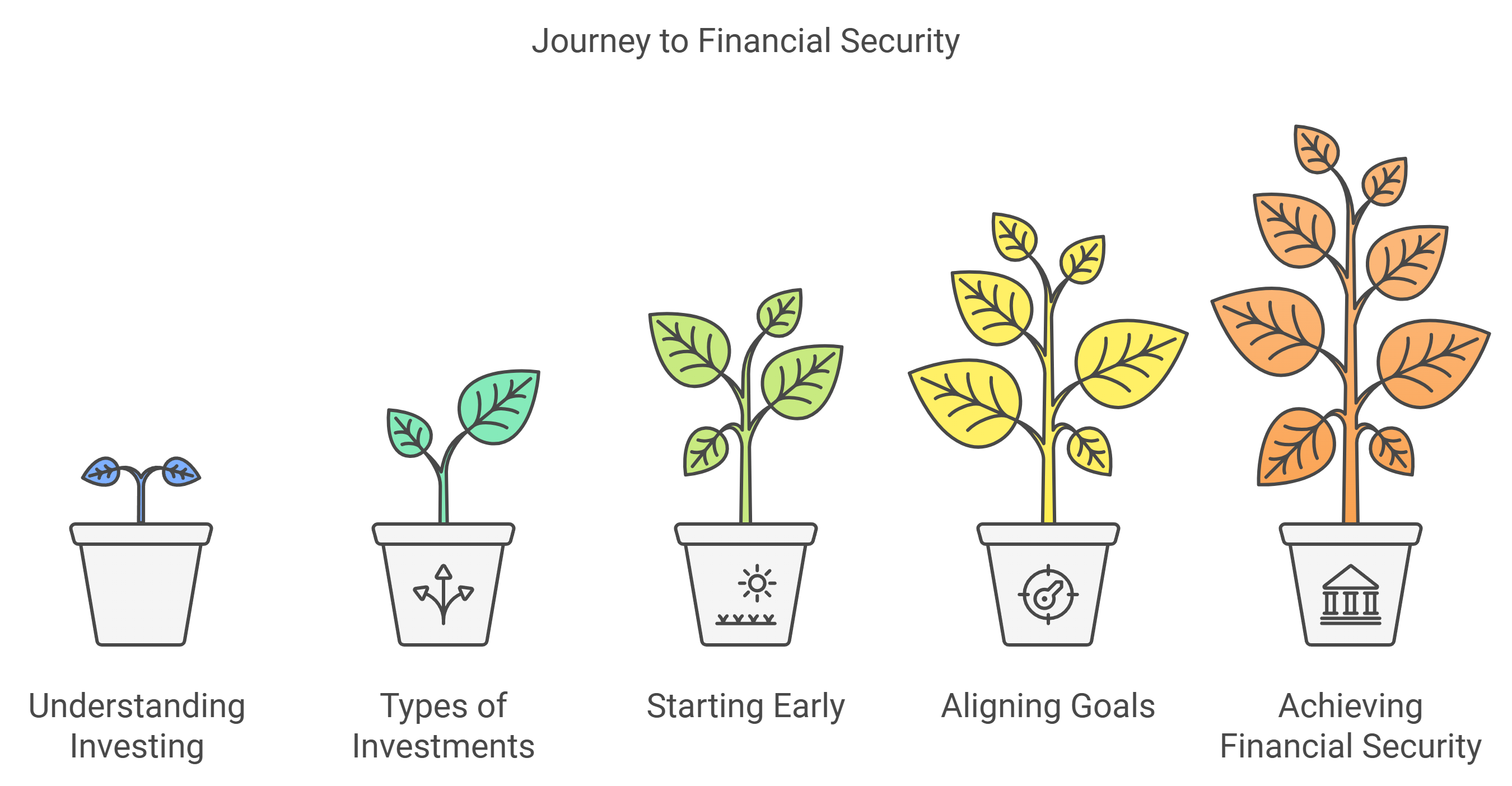

Imagine this: You’re scrolling through social media, and you see people talking about “making their money work for them” through investments. It sounds promising, but where do you even start? You might be thinking, “Investing is only for the wealthy,” or “I don’t have time to learn all that.” But here’s the truth: investing is for everyone, and understanding the basics is the first step toward growing your wealth and building financial security.

In this guide, we’ll break down what investing really means, why it’s important for your future, and the types of investments you can explore — even if you’re just starting out.

What is Investing?

Investing is essentially putting your money to work with the goal of earning more money over time. Unlike saving, where you put your money in a safe place (like a savings account), investing involves buying assets — things that can increase in value, such as stocks, bonds, or real estate.

Think of it this way: If you plant a seed today, you’re investing your time and effort into growing a tree. Over time, the tree produces fruit, and you can enjoy the rewards. Similarly, investing involves planting your financial “seeds” with the hope that they will grow and yield returns.

Why People Invest:

- Grow Wealth: Whether it’s for buying a home, funding a child’s education, or building a retirement fund, investing helps you grow your wealth over time.

- Beat Inflation: Inflation makes the value of money decrease. By investing, you can grow your money faster than inflation and maintain your purchasing power.

- Financial Independence: Investing gives you the freedom to achieve financial goals without relying solely on a paycheck.

Different Types of Investments

When it comes to investing, there’s no one-size-fits-all. The best investment strategy for you will depend on your financial goals, your timeline, and your comfort with risk.

Here are some common types of investments you can explore:

Stocks

Investing in stocks means buying a piece of a company — essentially becoming a part-owner. For example, if you buy shares of Apple, you own a small part of the company. Stocks are known for their potential to grow over time, but they can also be volatile in the short term.

Example: If you bought $1,000 worth of Apple stock 10 years ago, it would be worth several times more today, depending on Apple’s performance.

Bonds

Bonds are like IOUs. When you buy a bond, you’re lending money to a government or a company, and they promise to pay you back with interest. Bonds are generally safer than stocks, but they offer lower returns.

Mutual Funds and ETFs

Mutual funds and ETFs pool money from many investors to buy a diversified set of assets. This makes them a good option for those who want diversification without having to pick individual stocks.

Real Estate

Real estate investments include buying property — like rental homes or commercial spaces. Real estate can generate steady rental income and appreciate over time, but it usually requires more capital upfront.

The Importance of Starting Early

When it comes to investing, time is one of your best friends. The earlier you start, the more time your investments have to grow, thanks to the power of compounding.

Compounding:

Compounding is when the money you earn starts earning more money. Imagine you invest $1,000, and it earns 10% in one year—that’s $100. In the next year, you earn 10% on $1,100, and it keeps growing from there. This snowball effect helps even small investments grow into significant amounts over time.

How Do You Decide What to Invest In?

It’s all about aligning your investments with your goals and risk tolerance.

- Short-Term vs. Long-Term Goals:

If you’re saving for something short-term, like a vacation in a year, safer investments like bonds or high-yield savings accounts may be best. If your goal is long-term, like retirement in 20 years, stocks or real estate might make more sense. - Risk Tolerance:

Are you okay with seeing ups and downs in your portfolio, or would you lose sleep over it? Understanding your comfort with risk is crucial in deciding the types of investments that suit you.

Example: If you’re young and saving for retirement, you can probably afford to take on more risk because you have time to recover from potential losses. This means investing in growth stocks might be a good option.

Investing is a journey that starts with understanding the basics. As you learn more, you’ll discover which investment path aligns with your goals, whether it’s long-term investing in stocks, real estate, or even diversifying with bonds.

If you’re ready to explore your options and see how long-term investing could work for you, use ValueIt’s platform to evaluate different stocks and start your journey today. Remember, the best time to start investing was yesterday, and the next best time is today.